Quickly Learn Free Credit Score

Get a free credit score I explain one by one what needs to be done. There are many methods to query your free credit score. These methods are not known to most people. You can learn your credit score via e-Government, SMS or TC.

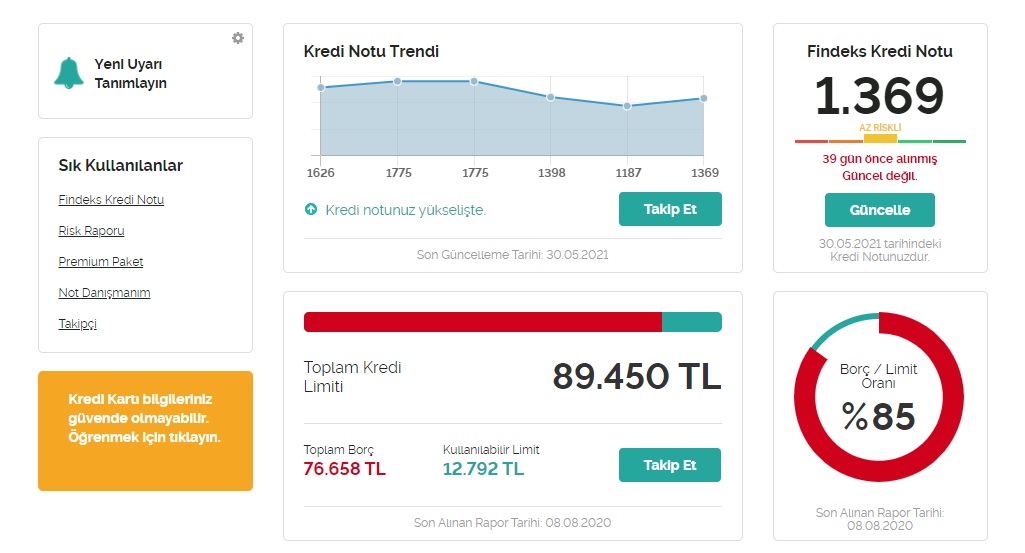

Findeks is a platform that creates your risk report for a fee. On this platform, you can learn how much credit you can take and your credit rating. With Findeks, you can track your loan debts and limits in banks and other financial institutions, your credit rating, and provide financial control.

How to Make Free Credit Score Learning Transactions?

They can question your credit score to take out a loan, apply for a credit card or rent a car. Banks can see this for free. When you want to take a loan from the bank, they examine your risk report.

Try the following free channels to find out your credit rating and risk report;

Text Contents

1. Get Free Credit Score Via E-Government

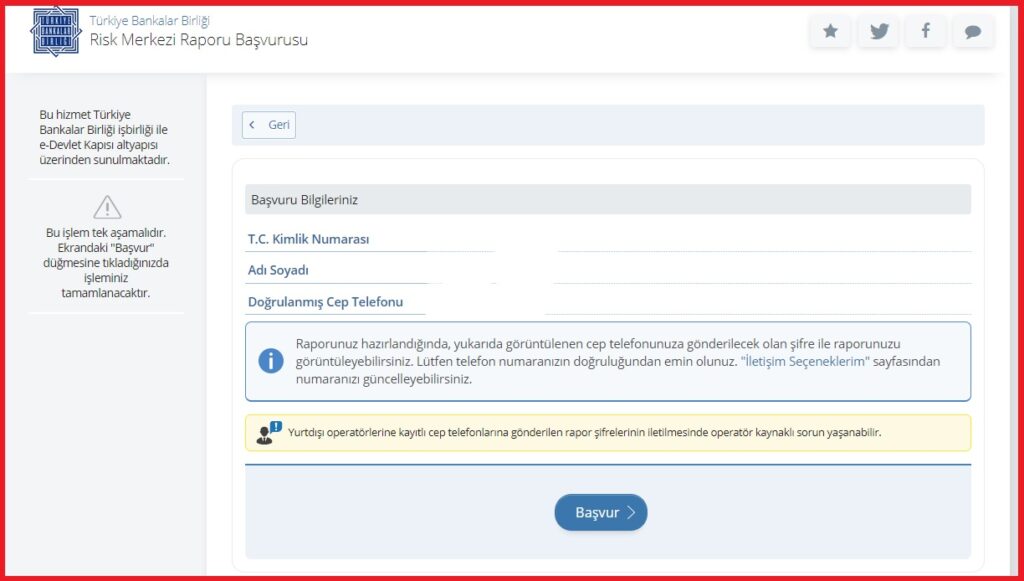

1) To find out your credit score via e-government, first Your Risk Center Report Login to address. After logging in here with your e-government information, a page like the one below will appear. found on this page New Application Click the phrase.

2) After clicking on the new application phrase When your report is prepared, you can view your report with the password that will be sent to your mobile phone displayed above. Please make sure your phone number is correct. You can update your number on the “My Contact Options” page. You will see the phrase.

After clicking the Apply button Your application has been successfully submitted to the Risk Center of the Banks Association of Turkey. When your report is prepared, you will be notified via SMS. You can then access your report from the “Your Application Information” page. You will receive a reply.

3) Then a message will come to your phone to access the report. Again Risk Center Report enter the centre.

4) Enter the password sent by SMS and the text in the picture in the fields on the screen that comes up. Download Report or a View Report Click the button.

2. From Bank Tolls

You can learn your credit rating from bank tellers and any bank. Go to any bank near you and take a turn. Even if you can't learn from the toll booths, there are individual customer representatives. You can inquire about your credit rating or risk report by contacting them.

Another method is customer service. Call the customer services of the banks and say that you want to apply for a loan or credit card. When you connect to the customer representative, you can learn your credit rating.

3. From Car Rental Companies

You can learn a free credit score from car rental companies. In general, corporate car rental companies have such a method. In order to rent the vehicle, your credit rating may be at a certain level.

I want to call the customer service of car rental companies and rent this car. Is my credit rating suitable? Just saying you don't know will suffice. Those in customer service will inform you about your credit rating.

What Should Your Credit Rating Be?

0-799: It is the lowest credit rating. It is in the risky group and the biggest reason for this is irregular payments. Even if you do not have a transaction at the bank before, you are included in this group.

800-1299: This grade range also indicates that you need a guarantor or show a mortgage to take out a loan. This is at the discretion of the banks.

1300-1499: This grade range is called the low risk group. Generally, if there is no problem, they can easily use credit.

1500-1699: This credit rating range is at a successful level. Those in this group are loyal customers and make their payments on time. Therefore, loan applications are positive.

1700-1900: Those who have this credit rating are the ones that banks consider the most reliable.

#Related Content: The Easiest Credit Card Issuing Banks

According to the credit rating ranges above, you can estimate whether the loan will be approved by looking at your credit rating. However, in some cases, even a person with a very good credit score is not given a loan. There are some reasons for this and banks explain this situation again. If you ask the bank why the loan is not approved, you can find a mutual solution.